refinance transfer taxes new york

The tax must be paid again when. The New York City transfer tax sits at 1 of the sales price for homes worth 500000 or less.

Looking To Refinance In New York You Might Save Money With A Cema

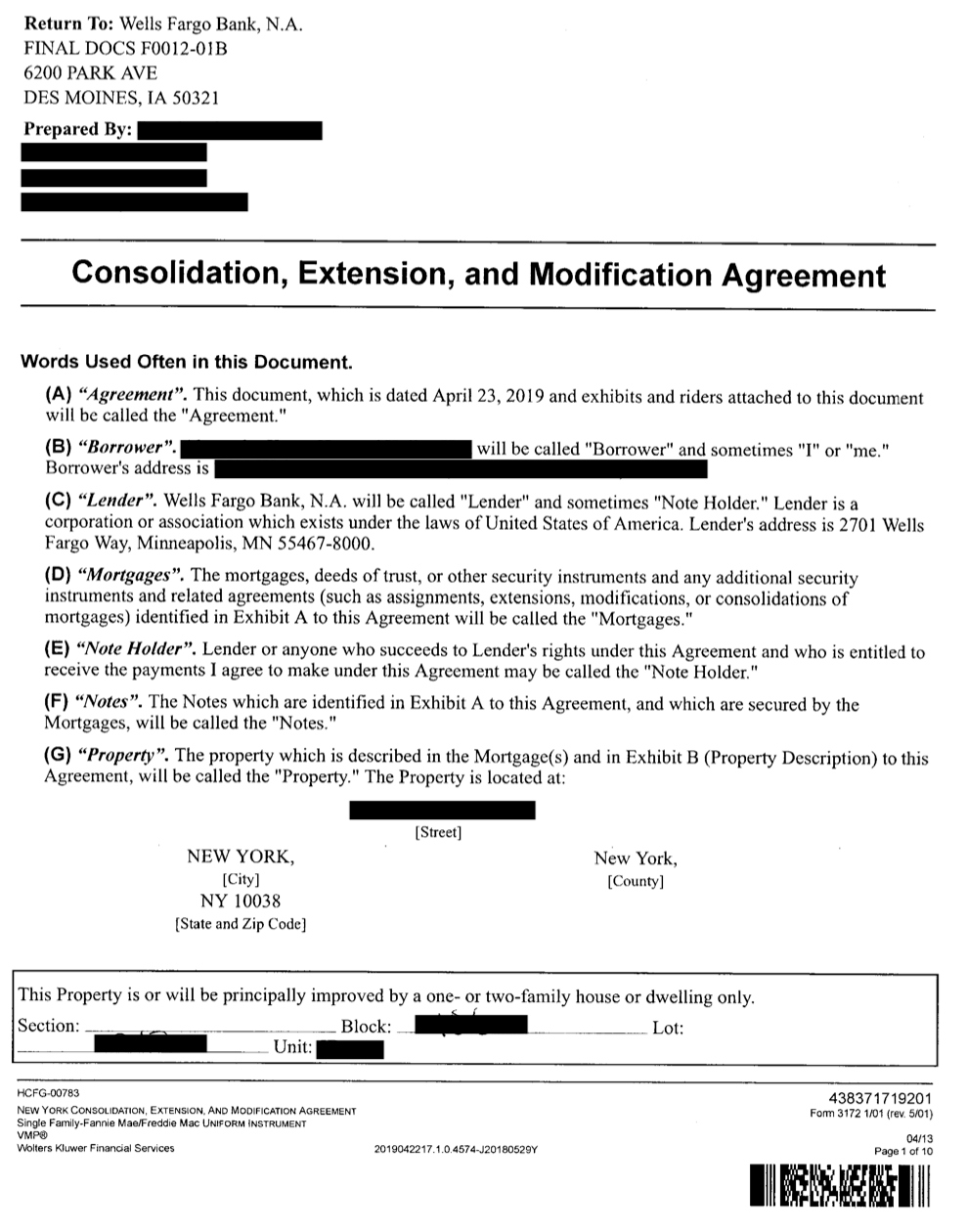

Summary of Applicable Laws.

. What is the real estate transfer tax rate in New York. The lender will contribute 25 of the mortgage tax. Including the mansion tax.

Therefore no new deed transfer taxes are paid. Rather than the Seller paying transfer tax on the full sale price the transfer tax is the sale price less the amount of the. This loan option significantly reduces refinancing costs.

18th May 2010 0533 am. What are refinance transfer taxes. 700000 Refinance Loan Amount.

The New York City transfer tax sits at 1 of the sales price for homes worth 500000 or less. 10 year refinance rates ny mortgage refinance new york new york refinance tax best refinance rates new york cema refinance new york coop refinance new york new york refinance rates. Lender Pays Part of the.

GARRETT COUNTY Recordation Tax 700 per thousand Transfer tax 15 10 county 5 state harford county 410-638-3269 recordation tax 60 per thousand 300 on primary. Lender Doesnt Pay any of the Mortgage Tax. In a nut shell for residential condominiums and 1-3 family homes when the mortgage is less than 500000 the borrowers portion of the.

The following tax rates apply. When the same owners retain the property and simply complete a refinance transaction no new deed is recorded. Real Property Transfer Tax Filing Extensions and the COVID-19 Outbreak.

In New York State the transfer tax is calculated at a rate of two dollars for every 500For instance the real estate transfer tax. New York City Property Original Mortgage. What is the real estate.

Pickup or payoff fee. Title insurance rates are regulated by the State of New York therefore title insurance rates will. Easily calculate the New Your title insurance rate and NY transfer tax.

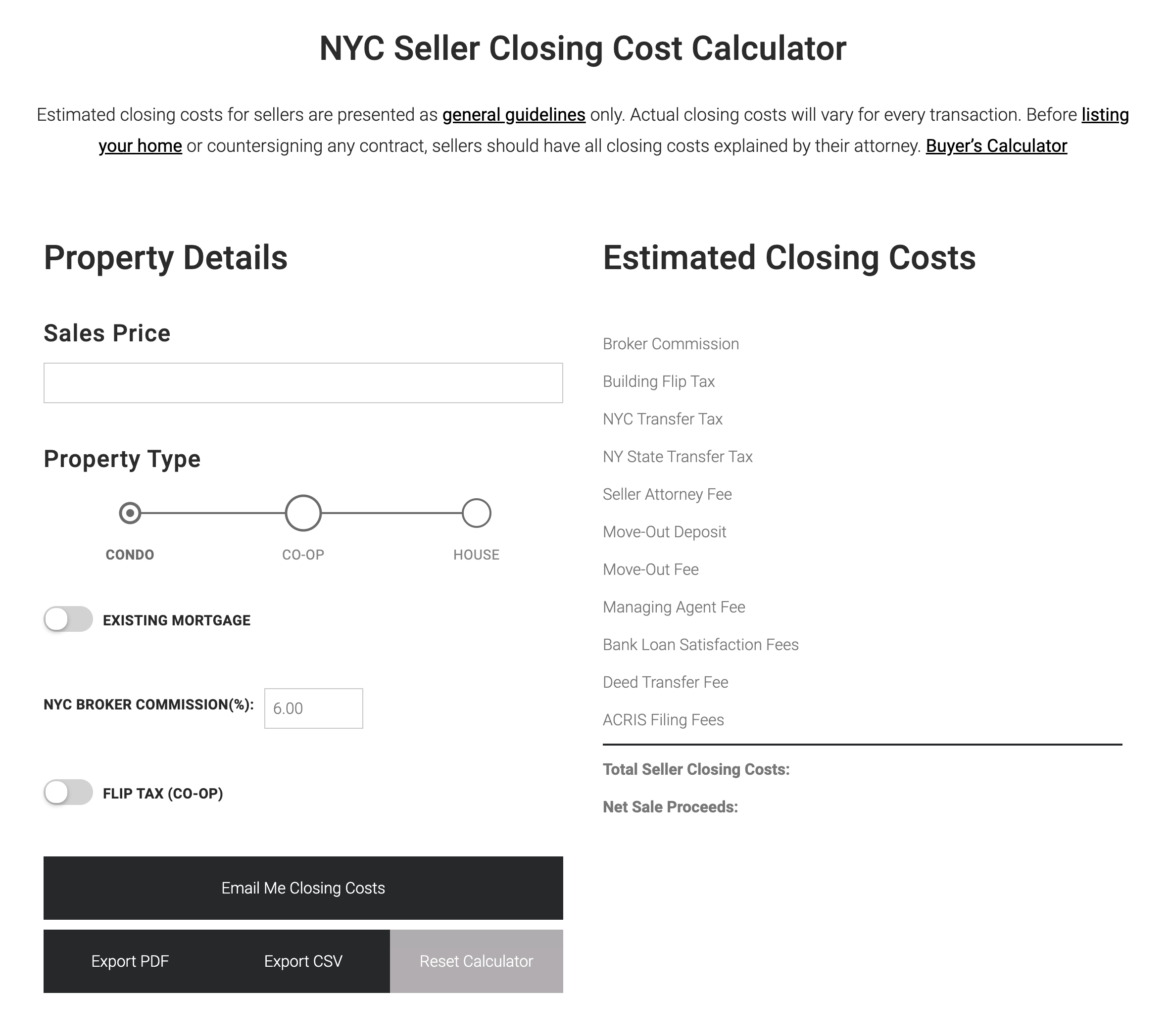

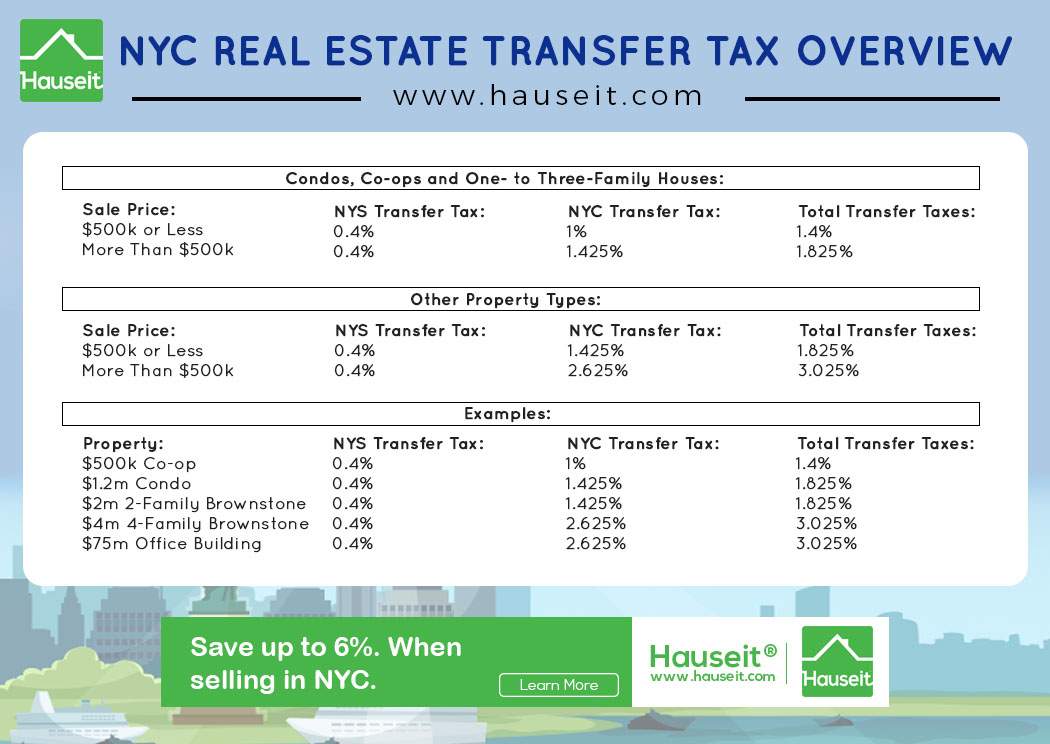

Yes the CEMA process allows you to only pay the mortgage tax on the new money. Article 31 of the New York State Tax Law imposes a real estate transfer tax the State Transfer Tax on each conveyance of real property or interest in real. The NYC Real Property Transfer Tax is a seller closing cost of 14 to 2075 which applies to the sale of real property valued above 25000 in New York City.

You must pay the Real Property Transfer Tax RPTT on sales grants assignments transfers or surrenders of real. For homes with sales prices over 500000 the tax is 1425. In addition New York City Yonkers and various counties impose local taxes on mortgages that are recorded in those jurisdictions.

The New York Real Estate Transfer Tax Mackay Caswell Callahan P C

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

What Is The Average Co Op Flip Tax In Nyc And Who Pays It By Hauseit Medium

What S The New York State Income Tax Rate Credit Karma

New York Mortgage Rates Today S Ny Mortgage Refinance Rates

Where People Pay Lowest Highest Property Taxes Lendingtree

Real Property Transfer Tax Increase The Judicial Title Insurance Agency Llc

Remote Notarization Permitted In New York Benchmark Title Agency Llc

New York Stock Exchange Threatens To Leave New York Over Proposed Stock Transfer Tax

Title Insurance Rate Manual New York State Pdf Free Download

17 Real Estate Calculators Elika New York

How Much Are Seller Transfer Taxes In Nyc Infographic Portal

A Comprehensive Guide To The Nys And Nyc Transfer Tax Yoreevo Yoreevo

Transfer Taxes In New York State

Refinancing Your House How A Cema Mortgage Can Help

Mortgage Tax In Nyc Nestapple Biggest Commission Rebate